Bitcoin: Blockchain, Mining, Energy

It’s no secret that Bitcoin and cryptocurrencies, in general, have gained significant popularity and notoriety over the last 12 months. Most notably because the return has been an astronomical 430% over the time period, but also due to companies such as Tesla, MicroStrategy, and Square investing a collective $3.9 billion earlier this year. For anyone invested in Bitcoin or following the asset, this last year has not been without its ups and downs.

What is Bitcoin?

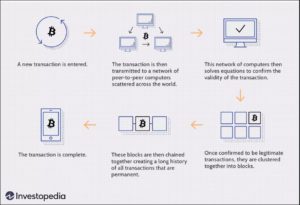

Bitcoin is a decentralized digital currency. All transactions made with bitcoin are noted on a public ledger and verified by a network of computers. Many people and companies are working to verify transactions instead of just one entity, making it decentralized. The public ledger of bitcoin transactions is stored in the blockchain.

What is the Blockchain?

Think of it simply as blocks being stacked on top of each other, one after the other, with each block containing different transactions. The massive network of computers mining the bitcoin is responsible for verifying each public transaction on the ledger. Once a block is full, it needs to be closed and another block opened for the next round of transactions. In order to close the block, an incredibly complicated math equation must be solved. Whoever is responsible for solving the equation is awarded bitcoin as payment.

While the bitcoin blockchain network is public, it remains completely anonymous. Each user is assigned their own specific public key. A long string of numbers and letters attached to each transaction instead of the user's name or username.

For more information and explanation on blockchain and how it can prevent large-scale attacks, click the links below.

What is Mining?

Mining is the process of solving a complex math problem required to close a block and add it to the chain. There are about four billion possibilities to sift through in order to solve the problem, thus confirming the necessity for equally complex and powerful computers. Miners who successfully solve the math problem are awarded their payment, currently worth 6.25 bitcoin. In dollars today, approximately $315,000.

However, mining doesn’t come without its own costs. Building these supercomputers and mining facilities is very expensive. Not only the upfront costs, but the expenses related to powering the systems are in a class of their own. If people and companies want to increase their chances of solving the equation first, they need more computers. More computers mean more electricity.

Using data from the University of Cambridge’s Bitcoin Electricity Consumption Index, VisualCapitalist put together a visual and chart of bitcoin’s power consumptions compared to other companies, states, and even countries. The bitcoin mining network consumes more electricity than the entire country of Norway. Considering this massive power need, there is hope the bitcoin mining network will be a boon to the global transition to renewable energy. To learn more about the relationship between bitcoin mining and renewable energy, click here.

The appeal of Pokémon sweatshirts lies largely in their ability to evoke nostalgia. For those who grew up watching Pokémon on television, playing the games.

ReplyDeleteCrafted from premium materials, the black Essentials hoodie offers both comfort and durability. Typically made from a cotton-polyester blend, it provides a soft, cozy feel while maintaining structural integrity over time. The fabric is thick enough to keep you warm during colder months, yet breathable enough for mild weather, making it an ideal all-season garment.

ReplyDeleteWhat I like most about CRTZ is how it’s not just about fashion but about culture. The designs are bold, unapologetic, and carry a message. It feels less like clothing and more like a movement.

ReplyDeleteStone Island has begun incorporating sustainable practices into its production, including recycled materials and environmentally conscious dyeing processes.

ReplyDeleteOne of the key features of the Essentials tracksuit is its premium material quality. Typically made from soft cotton blends with polyester, it offers a comfortable feel against the skin and durability over time. The fabric is designed to be breathable yet warm, making it suitable for various weather conditions. The attention to fabric quality ensures that the tracksuit maintains its shape and softness, even after repeated washing.

ReplyDeleteThe hoodie often incorporates hand-painted or embroidered details, which elevate it from mass-produced apparel to wearable art. Many designs feature motifs such as floral patterns, symbols of heritage, or subtle distressing that gives each hoodie a slightly unique look. These details are not merely decorative; they often carry deeper meaning, reflecting the brand’s commitment to storytelling through fashion. This artisanal quality makes each hoodie feel personalized, even in larger production runs.

ReplyDeleteCustomer feedback highlights the Seven Heavens hoodies' exceptional quality and comfort. Many reviewers commend the soft, brushed fleece interior that retains its plush feel even after multiple washes. The sturdy construction and attention to detail in stitching and finishes further contribute to the overall positive reception.

ReplyDeleteThe fragrance opens with top notes of lavender and black pepper, offering a fresh and spicy introduction. These notes are followed by a heart of coconut water, iris, and salt, creating a creamy and slightly salty aroma reminiscent of a beachside breeze. The base notes of vanilla and incense provide a warm and smoky finish, adding depth and longevity to the scent.

ReplyDeleteThe brand's commitment to quality is evident in their product descriptions. For instance, the Akimbo Zip-Up Hoodie in Blazing Orange is crafted from 100% brushed cotton, providing a soft and comfortable feel. It features a cropped fit, with sizing recommendations to ensure a true-to-size experience. The hoodie is unisex and designed for cold machine wash with hang-to-dry instructions, emphasizing both style and practicality.

ReplyDeleteOne of the standout features of Sisters and Seekers hoodies is their exceptional quality. Crafted from premium cotton blends, these hoodies offer softness without sacrificing durability. They are designed to withstand everyday wear and frequent washing while maintaining their shape and color. This attention to detail ensures that each piece feels luxurious yet functional, appealing to consumers who prioritize longevity in their wardrobe.

ReplyDelete“I’ve tried similar hoodies from Nike and Uniqlo, but the Essential Hoodie stands out in terms of comfort and layering. It just feels more thoughtfully made. Great for fall layering.”

ReplyDeleteThe rich chocolate-brown tone of this Essentials hoodie gives it a cozy, versatile look that pairs effortlessly with jeans or joggers.

ReplyDeleteCorteiz always keeps it exciting with those limited drops. You either catch it in time or you miss out. It adds that extra edge to every piece. Respect to how they run things.

ReplyDelete"Kanye’s merch always hits different. It’s more than just clothing — it feels like part of the album experience. Loved the DONDA drops."

ReplyDeleteThis hoodie uses a cotton‑blend material (some versions are 80‑90% cotton) that feels pretty soft. It’s breathable, warm without being too heavy, and the stitching seems solid. Perfect for layering or wearing on its own.

ReplyDelete“I love that Eme Studios designs for everyone. That gender‑neutral approach: no rigid categories, more versatility. It opens up possibilities. And the wearability is real: comfortable pieces that still look sharp, for different body types. That’s something that many brands could learn from.”

ReplyDelete"There’s something to be said about how streetwear continues to glamorize drug culture. The 'Awful Lot of Cough Syrup' hoodie looks cool, sure, but when you step back, it’s also normalizing some pretty heavy stuff. Just food for thought."

ReplyDelete“I was hesitant at first because of the price, but after wearing it a few times, I get the hype. It’s durable, warm, and the detailing is next level.”

ReplyDeleteHonestly, this Takashi Murakami hoodie feels like wearing a piece of contemporary art. The bold colors and signature smiling flowers make it instantly recognizable. I love how Murakami blurs the line between high art and everyday fashion.

ReplyDelete"Still amazed at how Sean John blended luxury and street so effortlessly. Velvet tracksuits, crisp button-downs, oversized coats—it had that NYC vibe but polished. Timeless stuff."

ReplyDeleteVrunk since the early days—watching the evolution has been wild. The latest drop? Next-level. Proud to see the growth!

ReplyDeleteThis was such a refreshing read. I appreciate the honesty and creativity you bring to your work, Nofs. Keep doing your thing!

ReplyDeleteCarsicko is definitely riding the wave of streetwear hype, but I wonder how sustainable it is long term. Would love to see more focus on story and community, not just limited stock and resale hype.

ReplyDeleteThey exchanged the truth of God for a lie, and worshiped and served created things rather than the Creator.” Madrid is beautiful, but even beauty can become a distraction when God is no longer at the center.

ReplyDeleteI get the appeal of limited‑edition merch drops. They build hype, make things feel exclusive, and when you score something it feels special. But it’s often frustrating: site crashes, merch sells out in minutes, and a lot of fans miss out.

ReplyDeleteThe opening is absolutely delicious — rich coffee and cinnamon, very addictive. But after a few hours, it dries down into something a bit too sweet for my taste. I was hoping for a stronger roasted coffee vibe in the base. Still worth trying for the price, though.

ReplyDeleteAzeelimoservice.com delivers premium limousine and black-car transport across Washington, D.C., offering airport transfers, corporate travel, special-event rides, and chauffeured tours. www.azeelimoservice.com

ReplyDeleteQuraan.pk is a trusted online store offering a wide collection of Holy Qurans, translations, tafseer, and Islamic books. From beautifully designed rainbow Qurans to Tajweedi and rare editions, it provides authentic publications by Taj Company and others. Perfect for personal use, gifts, and spiritual growth in every home.

ReplyDeletewww.Quraan.pk.com

Shop the latest Collection Of Hellstar Hoodie at sale price from Hellstar Official Store. Get Huge Discount On All Products. Order Now!

ReplyDeleteRhude Clothing is a modern fashion label where rhude meets luxury streetwear in perfect harmony. Founded in Los Angeles in 2015, Rhude blends minimalist design, premium fabrics, and narrative-rich collections that reflect the city’s culture and socio-economic messages . The brand’s signature aesthetic seamlessly fuses American iconography with nostalgic references,

ReplyDeleteRhude clothing

Chrome Hearts Clothing blends luxury and streetwear with bold, edgy designs and premium craftsmanship. From graphic tees to hoodies, each piece offers unique style, quality materials, and standout appeal — perfect for those who live fashion with attitude.

ReplyDeleteChrome Hearts Clothing

it’s awesome to see a thorough breakdown of how Bitcoin, the blockchain, and mining all tie into energy use and the broader system. I especially appreciated the way you linked the mining process (its hardware, large-scale electricity consumption, etc.) to real world costs. I’m curious: given the challenges you highlighted, do you see mining ultimately helping or hurting our transition to renewable energy?

ReplyDeleteChrome Hearts Clothing

Explore wide range of products, including Corteiz Cargos, tracksuits, hoodies, Cortiez Beanie and t-shirts on Cortiez Clothing. Sale 30% Off with free shipping.

ReplyDelete