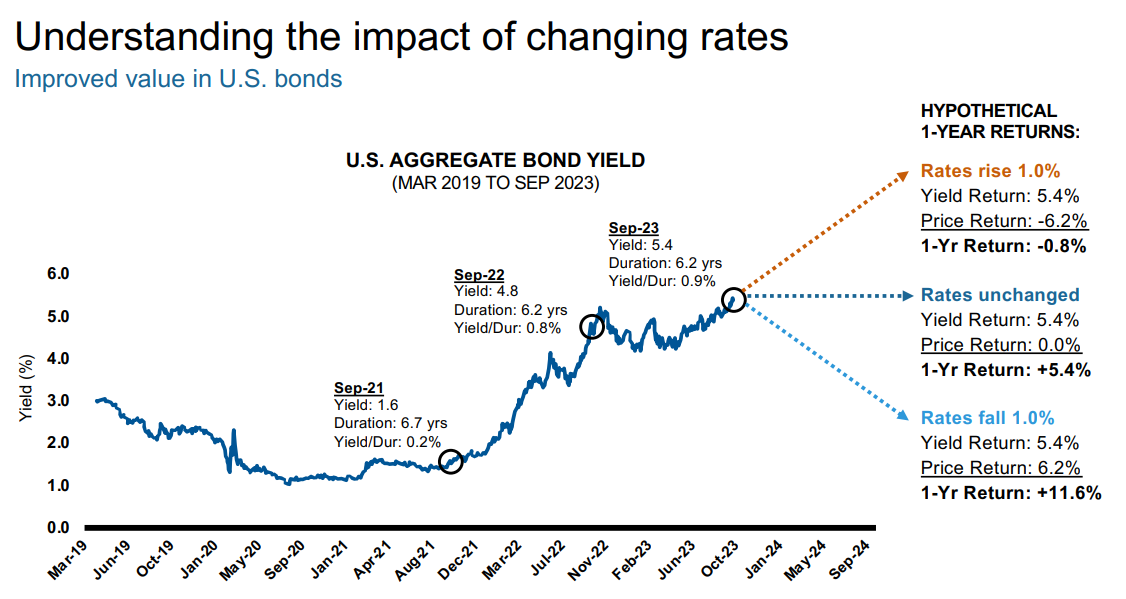

Interest rates and bond prices have an inverse relationship. When rates go up, bond prices go down, with the opposite being true as well. So as the Fed has hiked interest rates with breakneck speed to try and counter inflation, bond prices have fallen.

The chart above is a look at the US Aggregate bond index as of September with forward charting estimates based on potential rate changes. Based on current duration and yield:

- If rates increase 1.0%, we can expect the yield to return 5.4% (current) while experiencing a negative price return of -6.2%.

- The middle hypothetical shows a 5.4% 1-year return, all earned from the yield.

- Should rates fall by 1.0%, investors would expect to earn the yield return of 5.4% along with the positive price return of 6.2% for a total 1-year return of 11.6%.

No comments:

Post a Comment