Forward-Looking Markets

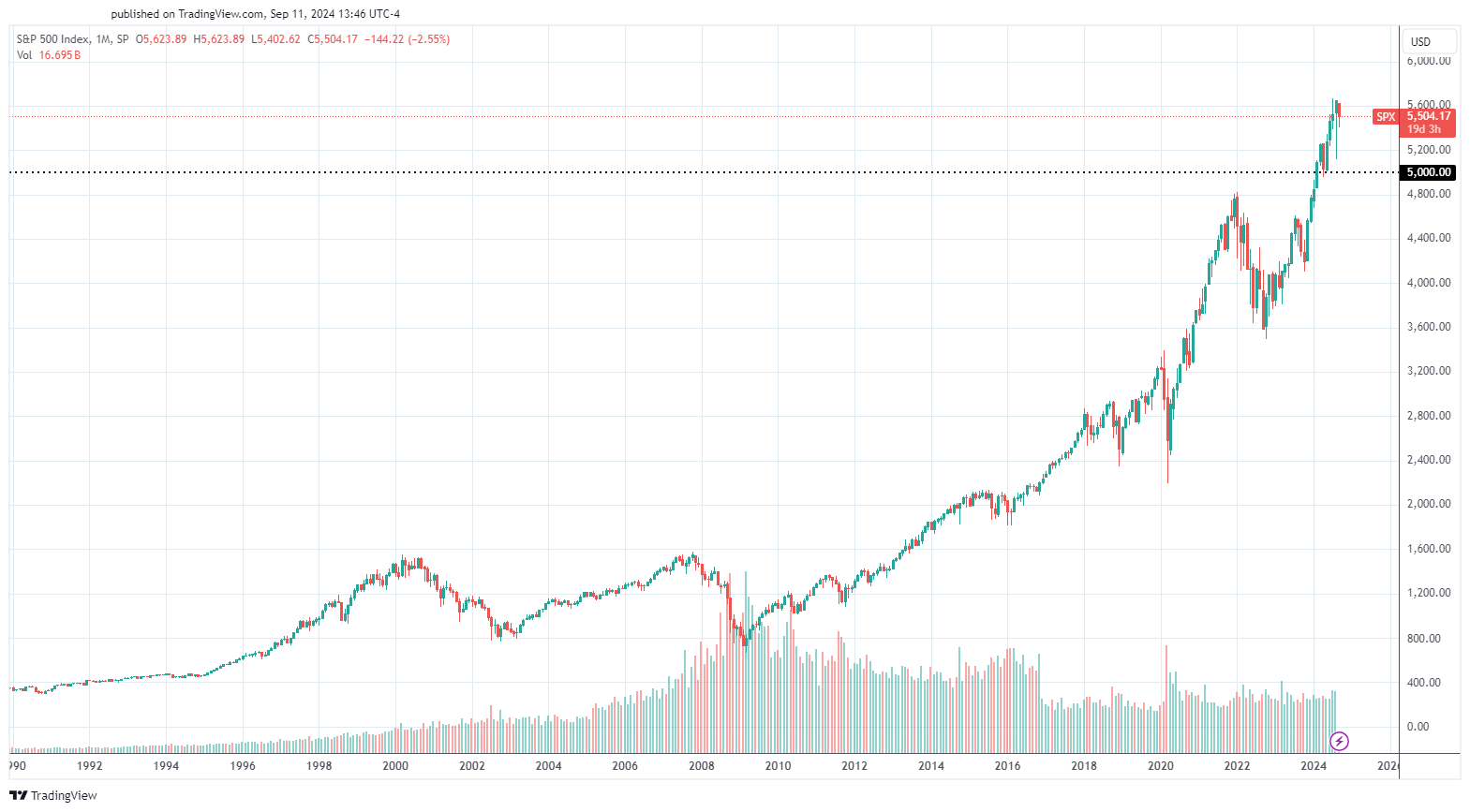

Whether we want to believe it or not, investment markets are optimistic. During times of volatility and swings in the market prices it’s hard to remember. But markets generally go up. Dating back to the very beginning market prices have gone up. It hasn’t been a flat line of course – there have been recessions and corrections and crashes – but here we are near all-time highs. We can’t get there without going up.

Current market prices are primarily derived from all available information – and there’s a LOT of it. The latest quarterly report from Nvidia was 80 pages long! But maybe more important than the stats on what happened last quarter are the projections for the future. Investment markets are forward-looking. If a company reports they blew last quarter’s earnings out of the water but are amending their projected earnings down, you’ll often see the price of the company drop. The future value of all earnings has fallen pushing the current stock price down as a result.

We’ll look at interest rates as a great example of forward-looking markets. The Fed’s next meeting is scheduled for September 17-18. The CME Group is a financial services company that operates the world’s derivatives exchanges. They have a webpage dedicated to tracking the probability of an interest rate cut and right now, they’re listing the probability of a rate cut at 100%.

On July 1st, there was still a ~40% chance that rates would remain unchanged in September. That 40% was quickly brought to 0% before the month was through. As the probability of a rate cut increased, the yield of the 10-year US Treasury decreased.

The Fed has yet to meet, and the Feds target rate is unchanged. Yet, market interest rates have already come down. The new information became available, and the markets reacted in anticipation of what we think will happen in the future.

No comments:

Post a Comment