What is “The Market”?

Volatility has played a big part in 2020 and there’s no sense it will stop anytime soon. More people are paying attention to the ebbs and flows of the stock market – whether they want to or not – thanks in large part to the news cycle. “Dow Soars 800 points…”, “Nasdaq jumps 2%…”, “S&P Futures eases below 3,600…”

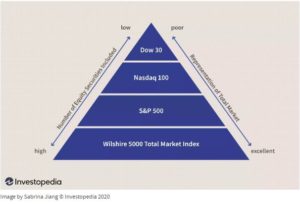

There are countless attention-grabbing headlines all seemingly referring to the same stock market, but promoting different letters and indices with varying percentages and numbers. What is the difference between the Dow Jones, the Nasdaq, and the S&P 500? And what does “The Market” actually mean?

The Dow Jones Industrial Average

One of the most widely known, and America’s original stock index, the Dow Jones is made up of 30 of the largest stocks from each major sector, excluding utilities and transportation. The value of the index is price-weighted, which means the index is only affected by changes in stock prices. A 1% price change for UnitedHealth Group ($351.70/share) has a much larger impact on the index than a 1% change in Cisco Systems (39.33/share).

Is the Dow a good measure of the stock market?

There are better. While it takes into account industry leaders, there are only 30 stocks measured in a world of hundreds and hundreds of stocks. Plus, it’s only measured by price changes which can sometimes be misleading.

As the title suggests, the Nasdaq 100 is made up of 100 different stocks. The description from Nasdaq’s website explains the index as, “one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization”. Unlike the Dow, the value of this index is based not on the prices, but instead on the market cap of each company.

Is the Nasdaq a good measure of the stock market? It’s better than the Dow, but still not the best. The Nasdaq is very tech-heavy and growth-focused, so it doesn’t do an adequate job of measuring the market as a whole. Additionally, it only makes up 100 stocks where there are multiple hundreds of companies.

The S&P 500

This index tracks 500 of the largest U.S. companies in the stock market. The index is market cap-weighted like the Nasdaq and therefore a 10% change in a $20 stock will affect the index in the same way as a 10% change in a $50 stock will.

Is the S&P 500 a good measure of the stock market? Yes! This index has a much broader look at the overall market and is much more encompassing compared to the Dow or Nasdaq. When referring to “the market”, this is what most people mean!

There are still downsides to using the S&P 500 as a measure of the overall stock market. To learn more, click here to see the post, “S&P 500 Dominated by Tech Mega Caps”.

Volatility, Time, and Diversification

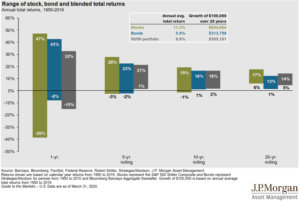

As we continue through these uncertain times, volatility will stay heightened, stock market headlines will stay at the forefront, and emotions can run wild. It’s important to remember time in the market is more effective than trying to time the market. Over shorter periods of time, investment returns and volatility can vary widely; however, long-term investors are rewarded for their time in the market, not for trying to time the market. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes. We remind clients to keep their next 7-12 years of anticipated cash distribution needs in stable assets such as cash, CDs, and short-term bonds.

This comment has been removed by a blog administrator.

ReplyDelete