Market Predictions

“The only function of economic forecasting is to make astrology look respectable.” – John Kenneth Galbraith, Economist

THE 2021 MARKET PREDICTIONS ARE IN, AND THEY’RE PROBABLY WRONG.

Every year, the top investment banks, research institutions, and market analysts make their predictions on where the S&P 500 (stock market) will close the year. They have mountains of research at their disposal, a slew of economic indicators, and they still get it wrong most of the time.

Take 2008 when the markets fell 38% as an example:

- “Stocks will reach new record highs at some point during the upcoming year.” – Robert C. Doll, Vice Chairman and Chief Investment Officer of Global Equities at BlackRock (January 2009)

- “It is hard for us, without being flippant, to even see a scenario within any kind of realm of reason that would see us losing one dollar in any of these [credit default swap] transactions.” – Joseph Cassano, AIG financial products head (August 2007)

- “The Federal Reserve and Congress have delivered a ton of economic stimulus, and that stimulus is set to juice up an economy that has been weak, but not terrible. If everything goes according to plan, the economy will grow faster in the second half of the year, and a recession will have been avoided.” – Kevin Hassett, American Enterprise Institute (June 2008)

Or 2017 when the markets rose 19%:

- “However, we see a down market in H2 [second half] 2017, hence our year-end 2017 target of 2,300 (3% gain).” – Credit Suisse

- “Our mid-2017 target is 2,250 while our preliminary 2017 year-end target is 2,325 (4% gain).” – Citi

- “We think that, fundamentally, risks for equities in 2017 are likely to be higher compared to this year (year-end target 2,400. 7.5% gain)” – JPMorgan

What’s the point?

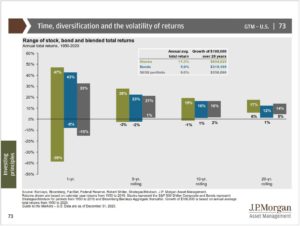

No one has a crystal ball. No one can predict the future. It’s cliché, but true. When analyst forecast’s starting hitting inbox’s and making headlines, simply ignore them. If there is one key takeaway from learning the poor track record of predictions, it’s to remember the importance of a diversified allocation. Over shorter periods of time, investment returns and volatility can vary widely; however, long-term investors are rewarded for their time in the market, not for trying to time the market. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes.

“Today’s headlines and tomorrow’s reality are seldom the same.”

This comment has been removed by a blog administrator.

ReplyDelete