Forward-Looking Markets

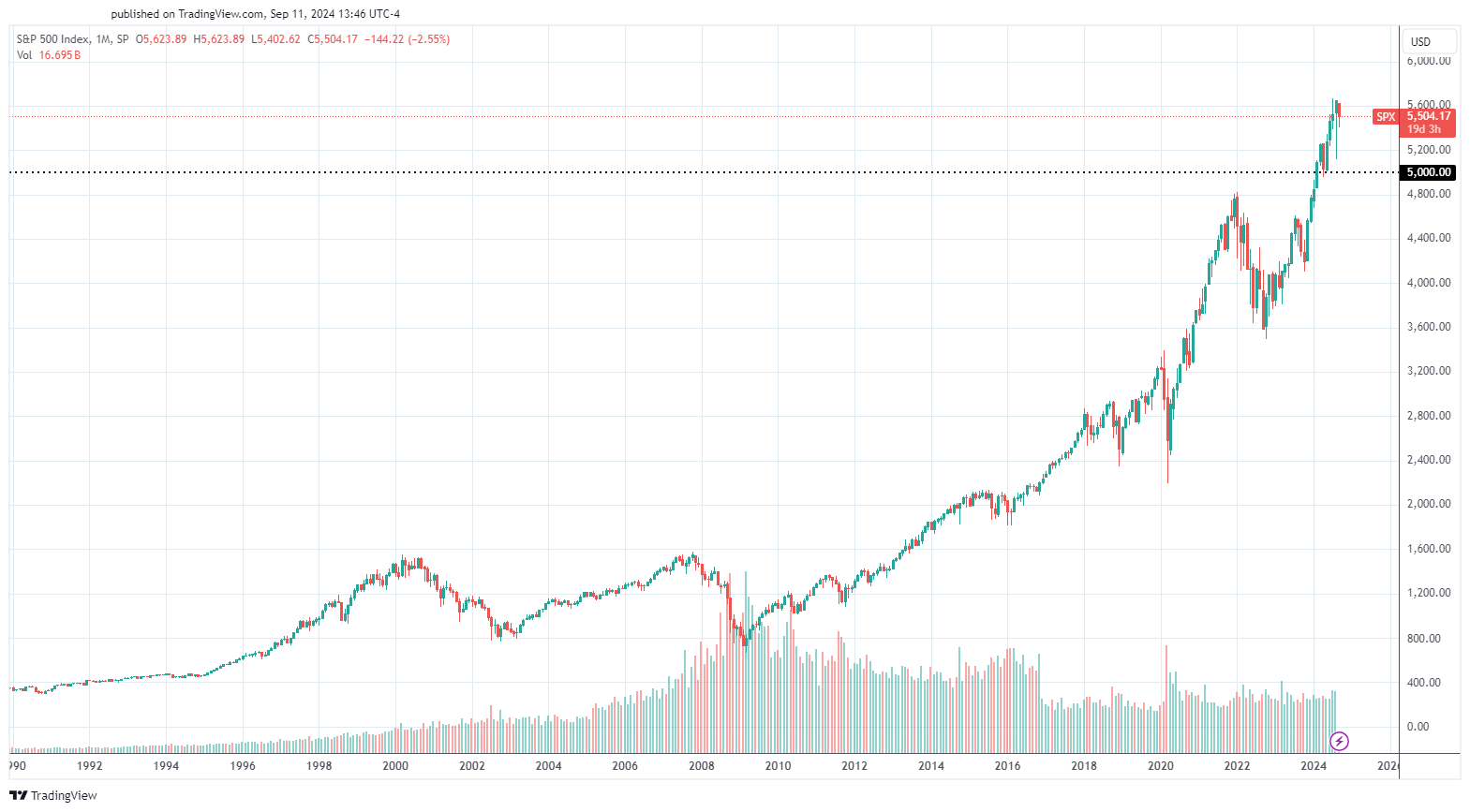

Whether we want to believe it or not, investment markets are optimistic. During times of volatility and swings in the market prices it’s hard to remember. But markets generally go up. Dating back to the very beginning market prices have gone up. It hasn’t been a flat line of course – there have been recessions and corrections and crashes – but here we are near all-time highs. We can’t get there without going up.

.jpg)