Benchmarking

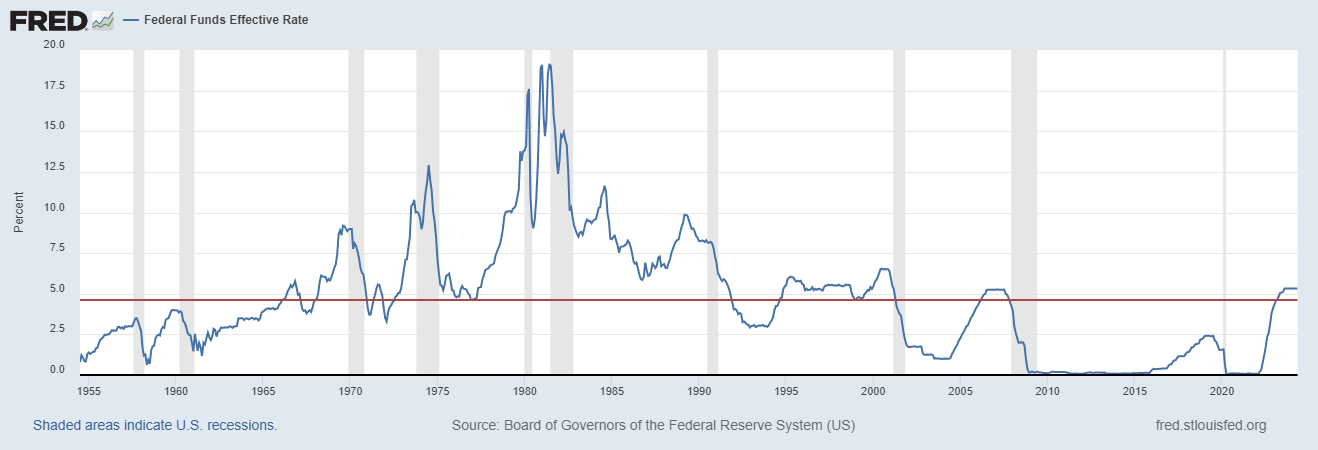

Benchmarking is defined as evaluating or checking something by comparison with a standard. When we think about investments, the benchmark is usually (right or wrong) the S&P 500 index. The trick to benchmarking is picking the right one. Investors with a lower risk tolerance with investments mostly in bonds and cash would likely be confused comparing the performance of their portfolios to the performance of the S&P 500. The same way an investor solely holding international stocks wouldn’t be wise to benchmark against the S&P 500. With the right comparison selected, we can better manage our expectations. I was catching up with a friend recently and he brought this up with interest rates. The idea is that, since interest rates were at or near 0% since mid-2009, 0% is the benchmark many are using now. Thinking that rates will eventually be cut from the current 5.25% down to 0% again. Bringing with it the idea that mortgages could move back down to the 3%’s and car loans to the same territory. But 0% may be the wrong benchmark. The average Fed Funds rate since 1955 is 4.61%, while the Fed has stated their long-run projection is 2.80%. Perhaps expectations for mortgage rates and bond price growth need to be tempered when a more realistic benchmark is used.